Situation of the French semiconductor market at 4th quarter 2024

Paris, March 24, 2025 – The French semiconductor market fell by 5% in the fourth quarter, to 496 million euros, compared with the third quarter, according to Acsiel Alliance Electronique (the European market is down 6% sequentially, according to WSTS). Year-on-year, the French market is down 19% (versus fourth quarter 2023). The French market index on a sliding annual average has been declining for six quarters (see graph 1 below).

The market was dragged down by direct sales to end customers, which recorded a sequential decline of 13% (-16% year-on-year). Two segments, smart cards and automotive, were the main contributors to this decline. In terms of products, the two main families to bear the brunt of the quarterly decline were MOS microcomponents and analog circuits, in that order, while MOS logic returned to growth (+20%) after three quarters of decline. Sales to distributors enjoyed sequential growth of 12% after six consecutive quarters of decline, despite a sharp year-on-year contraction (-25%).

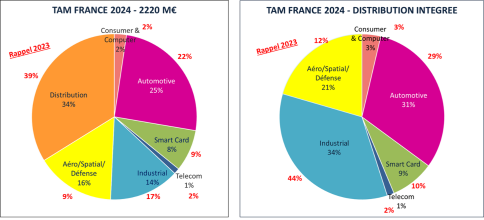

For the full year 2024, the French semiconductor market fell by 15% to 2.2 billion euros. Sales to the distribution sector were the main drag on the year’s results, down 27%. These represent 34% of the market, compared with 39% in 2023. Direct sales to end customers were less affected, with a decline of just 8%, especially as the main contribution to this drop came from the industrial segment (-32%), ahead of smart cards (-23%). By contrast, the drop in sales to the automotive segment was relatively limited (-4%), and this segment remains by far the most important in direct sales, accounting for 38%. The other segments declined significantly in 2024, with the notable exception of the aerospace/defense market, which grew by 55%.

Results for both the fourth quarter and full-year 2024 were affected by persistently high inventory levels in the industrial, automotive and retail sectors, and ultimately across the entire value chain. The critical situation in the construction sector that characterized 2024, as well as cuts in subsidies, had a negative impact on certain industrial markets (home automation, meters, heat pumps, etc.). More favorable prospects are beginning to emerge, with the building sector showing signs of a revival thanks to falling interest rates. The industrial sector in general is showing signs of a timid recovery, with orders picking up again. The second half of 2025 should see a more significant market recovery, with the end of over-inventories. In the longer term, the construction of data centers for artificial intelligence should have a very positive impact on the industrial sector, particularly in the field of circuits dedicated to energy management.

For the smart card sector, historically a specific strength of the French integrated circuit market, this is not strictly speaking a structural decline, but rather a technological mutation. In mobile telecoms in particular, the on-board SIM card is leading to a shift in the market, displacing sales from inserters to phone manufacturers, and ultimately impacting microcontroller billings.

As far as the automotive sector is concerned, the slowdown in electric vehicle sales in 2024 is likely to be no more than a temporary downturn. The return to growth, combined with the leverage effect of the product mix, will continue to stimulate the semiconductor market (particularly for power circuits). Last but not least, the international situation, which is driving up defense spending in Europe, and the very favorable outlook for the civil aeronautics industry, will be a boon for the French semiconductor market in the short and medium term.

Each year, Acsiel assesses the breakdown of the market by major segment, after reallocating sales made through the distribution channel (see graph 2 below). Industrial remains the leading segment with 34%, but down 10 points year-on-year, ahead of automotive (31%). The aerospace/defense sector, third in size, saw its market share rise from 12% to 21%.

As we take stock of 2024, a year marked by a significant downturn in the French market, it is vital to separate cyclical trends from the structural needs linked to the strategic objectives assigned by the public authorities to the industries necessary for sovereignty. Funding under the “France 2030” plan obviously has no immediate impact on domestic demand for semiconductors. The investments will bear fruit later, but the future is being prepared now, and it is crucial to continue supporting innovation, R&D and the production base.

![]()

Quarterly trends in the French market since 2010, in indexes, annual moving average – Source ACSIEL

Breakdown of the French market in 2024, counting distribution separately and reintegrating it into the segments – Source ACSIEL