Electronics barometer #ACSIEL – 1st quarter 2024

Paris, December 9, 2024 – Since 2017, the Acsiel electronics barometer has aggregated quarterly sales for the electronics industry in France.

Two indexes make up this barometer: :

- one indicates sales linked to electronic components (semiconductors, passives, printed circuits, connectors) and consumables (solder pastes, flux, accessories) intended for industry

- the other refers to sales related to electronic test and measurement equipment, electronic card production equipment.

The College Equipment & Services and Test & #Acsiel Measurements has just finalized the barometer for the 1st quarter of 2024.

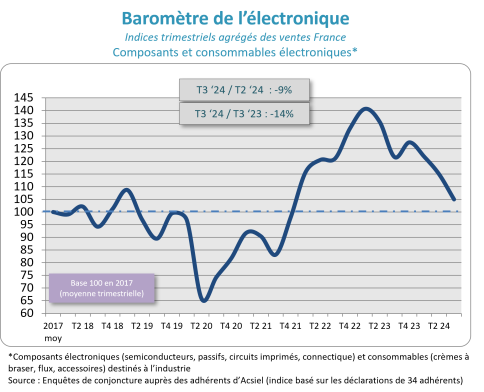

> Composants et consommables électroniques

Analysis

The Acsiel index of electronic components (semiconductors, passives, printed circuits, connectors) and consumables fell by 9% in the third quarter of 2024 compared with the previous quarter, representing a year-on-year decline of 14%.

All components of this composite index were down: semiconductors, passives, connectors, printed circuit boards and consumables for the electronics industry.

The semiconductor market, which weighs most heavily in the index, declined by 11% in the third quarter, mainly due to the sharp drop in sales to the industrial segment, both direct sales and sales through the distribution channel. By contrast, other segments reported solid growth, notably automotive, aerospace/defense and smart cards.

Inventory corrections continued to hold back the market, but these are coming to an end and are reflected in shorter delivery times. Manufacturers have invested heavily over the past two years and are now ready to respond to the return to growth.

Component markets in France are directly or indirectly exposed to the slump in the construction sector and to Chinese competition from end customers for certain industrial and automotive products. The aerospace market is in structural decline due to competition from SpaceX. On the other hand, order books are well-filled in the defense sector, offering favorable prospects for 2025, and in aeronautics the horizon looks clear for at least the next ten years.

Finally, we need to be aware that current political and economic uncertainties are having a negative impact, helping to delay certain projects or put investments on hold.

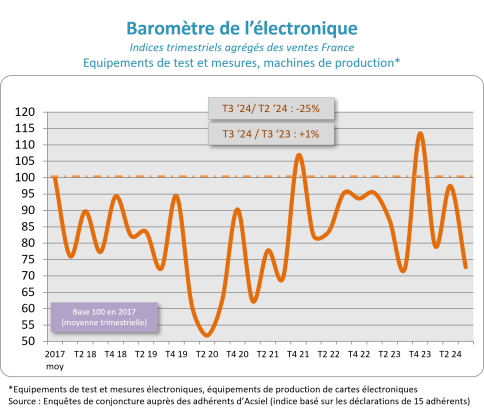

> Test and measurement equipment, production machines

Analysis

In the third quarter of 2024, the Acsiel capital goods index for the electronics industry suffered a relapse with a sequential decline of 25%, following 23% growth in the second quarter. Year-on-year growth, which had risen to +12% in the second quarter, fell back to +1% in the third.

However, there is as yet no reason to interpret this downturn as an economic turnaround, for a number of reasons:

- Quarterly fluctuations of considerable amplitude are usual in these capital goods (as our graph shows),

- Seasonality means that the third quarter is usually negative,

- Investments do not follow a regular flow, but rather come in successive waves, depending on budget execution combined with project completion,

- The lack of visibility due to the uncertain political situation was certainly not conducive to investment over the summer.

We’ll have to wait for the results of the fourth quarter, and perhaps into the early months of 2025, to differentiate between what is purely seasonal and what is a deeper trend, and to judge the progress of certain projects.

In particular, it is still too early to assess the impact of the European automotive industry’s difficulties. On the other hand, the defense and aeronautics sectors remain very buoyant, with medium- and long-term prospects.