Electronics barometer ACSIEL – 1st quarter 2025

Paris, June 23, 2025 – The Acsiel electronics barometer has been aggregating quarterly sales in the electronics sector since 2017 in France.

Two indexes make up this barometer: :

- one indicates sales linked to electronic components (semiconductors, passives, printed circuits, connectors) and consumables (solder pastes, flux, accessories) intended for industry

- the other refers to sales related to electronic test and measurement equipment, electronic card production equipment.

The College Equipment & Services and Test & Acsiel Measurements has just finalized the barometer for the 1st quarter of 2025.

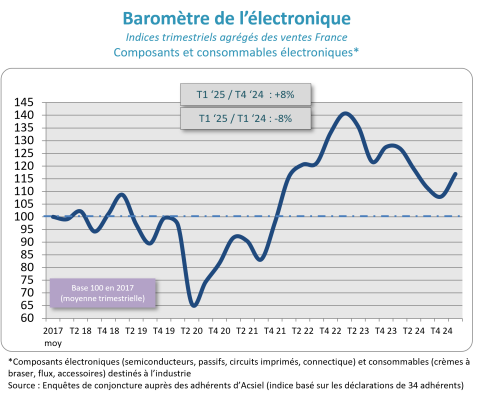

> Electronic components and consumables

Analysis

With sequential growth of 8%, the Acsiel index of electronic components (semiconductors, passives, printed circuits, connectors) and consumables recovered in the first quarter of 2025 after three consecutive quarters of decline. Year-on-year, the first-quarter trend remains negative (-8%).

The turnaround observed in the first quarter is largely due to growth in sales of semiconductors for retail and automotive customers. It should be noted, however, that all the components in this composite index benefited from a favourable economic climate, with results up or at least stable.

The European aerospace industry is benefiting from buoyant winds, with clearly positive spin-offs for the electronics industry as a whole. Defense, too, is structurally expanding strongly, although a drop in orders has been observed, particularly in semiconductors, in connection with financing problems.

Excess component inventories throughout the value chain, which caused the index to fall in 2024, have now largely been cleared. A concrete example of this can be found in the growth of semiconductor sales to distributors, a clear illustration of how the situation has improved. Final demand for components is therefore gradually realigning with production growth in downstream industries.

Some electronic component manufacturers claim to have hit bottom as early as summer 2024, others towards the end of the year. But generally speaking, the prevailing impression is that we have now entered a recovery phase. Projects that had been frozen between 2022 and 2024 are being relaunched. The European environment is also tending to improve, particularly in Northern Europe and Spain, although Germany is still lagging behind.

While a return to moderate growth is currently the preferred scenario for industry players, a cautious optimism is in order, given the uncertainties arising from an unstable international environment.

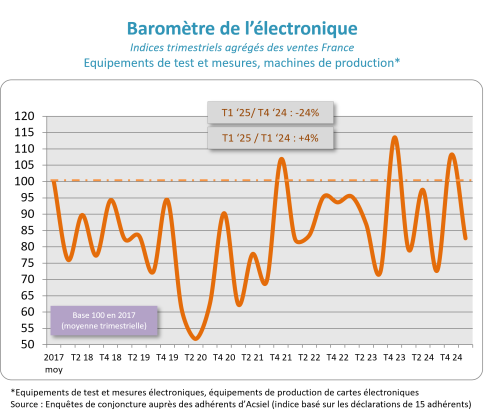

> Test and measurement equipment, production machines

Analysis

In the first quarter of 2025, the Acsiel capital goods index for the electronics industry fell by 24%, in line with the seasonal pattern for this type of industrial equipment. Year-on-year, however, the index is up 4%, an improvement on the fourth quarter of 2024 when our index was down 5%.

The defense, aeronautics and aerospace sectors are considered buoyant throughout Europe. The automotive and industrial sectors are at a standstill. Railways, on the other hand, are seeing a lot of development.

Visibility is sometimes lacking, as orders tend to be taken at the last minute.

Business is brisk in the education sector, with vocational baccalaureate and advanced vocational diploma courses. This is interesting, because it is the future technicians of our industry who are being trained, and we are facing major recruitment difficulties. What’s more, as far as developers are concerned, a more restrictive immigration policy is likely to worsen the situation, as many applicants come from abroad.

It should also be added that, in addition to the persistent shortage of manpower, which is an obstacle to growth, manufacturers are confronted with numerous logistical and administrative problems on a daily basis.