Situation of the French semiconductor market in the 4th quarter of 2022

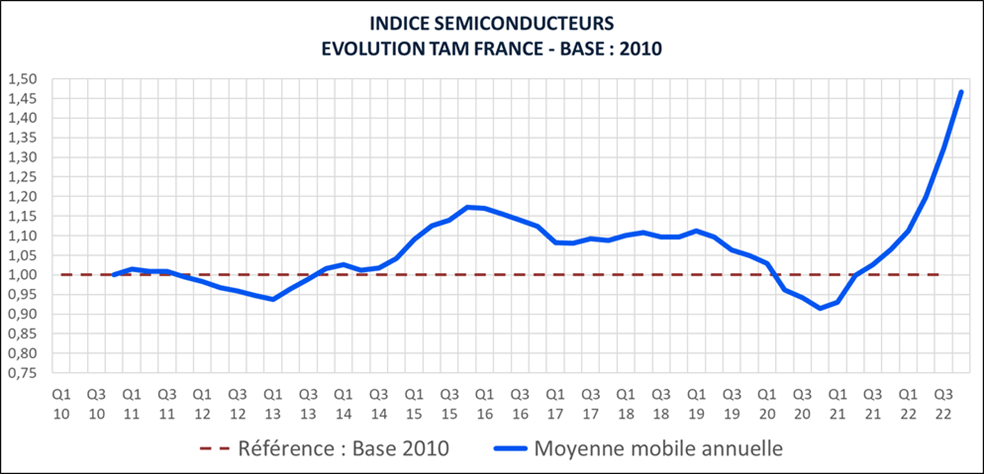

Paris, February 28, 2023 – The French semiconductor market recorded sequential growth of 15% in the fourth quarter (including +22% for sales direct and +5% via distribution) to 720 million euros, according to Acsiel Alliance Electronique. This growth illustrates the resistance of the French market compared to the entire European market which recorded a decline of almost 2% in the fourth quarter, and even more in view of the 8% drop in the global market (according to the WSTS) .

The year 2022 ended in France with remarkable growth of 38% and sales reached 2.5 billion euros over one year for the first time. This growth was particularly high through the distribution channel (+48%) while direct sales increased by 33%. The share of distribution in total semiconductor sales in France has thus reached the record level of 36% in 2022 whereas it was 25% in 2012 and 31% in 2021. In times of shortage, the increased use to distribution certainly meets customers’ needs to increase the security of their supplies. On the French market, the regular growth in the weight of distribution is also linked to the structural importance of industrial markets, a substantial part of which traditionally passes through this channel.

Sales of chips to the industrial segment increased by 43% in 2022 (including deliveries through distribution), strengthening the dominant share of this segment with a record level of 40% of the French market. Energy-related applications and in particular the development of charging infrastructure for electric vehicles have strongly stimulated this growth.

The automotive segment, which represents 32% of the French market, also benefited from strong momentum (+34%) due to the growth of electric vehicles for which the average electronic content is significantly higher than in thermal engine vehicles. . Electrification and driver assistance systems are currently the main growth factors in the automotive semiconductor market.

The two other pillars of the French market are the aeronautics/space/defense sector, which is experiencing strong acceleration (+64% in 2022), and the rapidly expanding secure applications traditionally grouped under the term “smart card” (+27%).

These results show a strong dynamic French semiconductor market, backed by a robust electronics sector, and until now spared by the economic downturn in the global market that occurred during the second half of the year. The segments that structure the French market give it relative protection from the economic ups and downs and volatility characteristic of the global semiconductor market and provide it with solid growth prospects in the medium term. This bodes well in a context of affirmed priority of industrial relocation marked by an unprecedented financial commitment from public authorities at national and European level in favor of microelectronics, more than ever identified as an industry of sovereignty.