Situation of the French semiconductor market in the 4th quarter of 2023

Paris, March 25, 2024 – The French semiconductor market returned to growth in Q4 after two quarters of contraction. According to Acsiel Alliance Electronique, total sales in France rose by 3% on Q3, to €615 million. This represents a contraction of 15% compared with Q4 2022. The market’s annual moving average curve has dipped slightly, but is only 5% below its historical peak in Q2 (see attached graph).

Quarterly growth was held back by a decline in sales to retailers (-4%) and, for the second consecutive quarter, by a sharp drop in direct sales to end-customers in the vast industrial segment (-17%). Apart from smart cards (+15%), growth was mainly driven by the Aerospace/Defense segment (+26%) and the rebound in direct sales to the automotive industry (+13%). In terms of product families, growth was driven by the rebound of analog circuits (+23%), MOS Micros (+10%) and MOS logic (+18%).

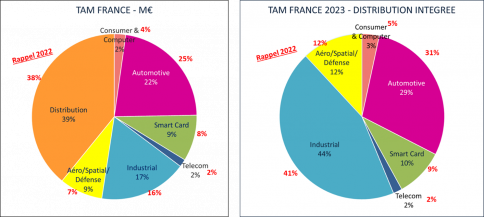

Over the full year 2023, the French market also recorded growth of 3%, to 2.6 billion euros. Sales to retailers (+6%) played a major role in this growth, reaching a record share of the French market with 39% of the total. Of the 61% sold directly to end customers, the strongest contribution to growth in absolute terms came from the Aerospace/Defense (+28%) and Industrial (+10% over the year, with very high sales volumes in the first half before a sharp downturn in the second) segments. The Smart Card segment had another good year (+9%), unlike sales to the automotive sector (-9%). Momentum in the French market was held back in 2023, in particular by inventory corrections that have not yet been fully completed throughout the value chain, and by falling demand in certain industrial sectors, notably home automation and machine vision applications. On the other hand, demand is strong in defense and avionics.

Beyond cyclical variations, the medium- and long-term outlook for electronics in France and Europe is very favorable, justifying the targeted support measures taken by public authorities at national level and the European Chip Act launched by the European Commission. However, in addition to the need for increased investment in these key sectors of technological and economic sovereignty, another major challenge for the industry’s growth is that of the workforce. The lack of training in electronics-related professions, combined with the forthcoming retirement of a large number of the age group hired in the 90s, can only exacerbate the talent shortage already perceptible in the microelectronics sector worldwide. This is an issue that requires the constant attention of all those involved, and calls for concrete measures without delay.

Quarterly trends in the French market since 2010, in indexes, annual moving average – Source #ACSIEL

Breakdown of the French market in 2023, counting distribution separately and reintegrating it into the segments