ACSIEL French Electronics Barometer

Paris, December 19, 2016 – ACSIEL Alliance Electronique, through its Active Components, Passive Components, Connectors & Printed Circuits, Subsystems, Equipment & Services and Test & Measurement Committees, now has an excellent overview of the French electronics offering and its key role in industrial and domestic applications. As each of these colleges has its own activity indicators, some of which have been available for many years, we have decided to group them together and comment on them as a whole, in order to provide our community with a more global vision of the situation of Electronics in France, through the activities of those who develop and/or consume these electronics. As our colleagues from SPDEI (Distribution) and SNESE (Subcontracting) have their own communication, the community will now have a comprehensive analysis of the situation.

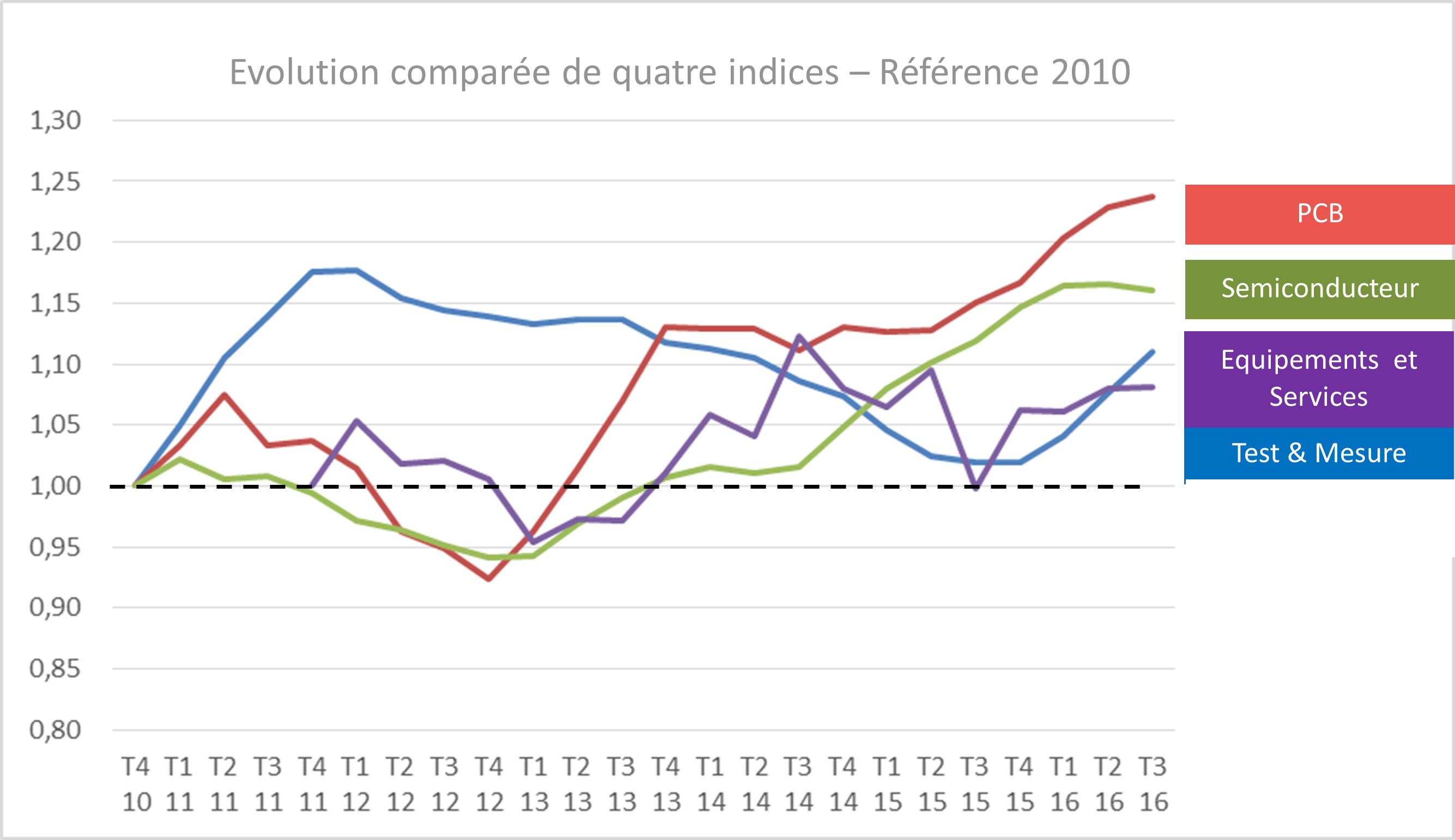

So, for the first time, we present our “ACSIEL French Electronics Barometer”, backed by business results to the end of September 2016. We can read the evolution of activity in Active Component (SC), Printed Circuit Board (PCB), Equipment & Services (E&S) and Test & Measurement (T&M). The curves correspond to a sliding average over four quarters, compared with a reference level set at the average for the four quarters of 2010.

First observation: there is a significant difference in behavior between Test & Measurement, which is mainly an investment (Test & Measurement has a mostly multi-year cycle), and the other three indicators, which are mainly a business (even though Equipment & Services can be broken down into two parts: services & consumables, which are mainly a business, and equipment, which is mainly an investment).

Second observation: we can see, on the other hand, that Assets, PCBs and Production Equipment behave in a more coherent way, supporting the interest of commenting on them as a whole.

Third remark: let’s not spoil our pleasure at seeing an upward trend in general, even if we will now try to “nuance” the situation, by approaching the subject through the applications served by the Electronics we represent.

Aerospace, Defense and Security

The export successes of our defense industry, recent space contracts and space constellation projects (which call for a new technical and economic approach) are among our growth factors. For example, the Aero/Mil market accounts for 50% of French printed circuit board production, which is currently rising sharply. Component volumes, like connector volumes, are limited by nature (compared with consumer markets), but are also growing. Finally, we are also seeing investments in Test & Measurement, combined with the recruitment of Electronics Engineers & Technicians. On the civil aeronautics side, on the other hand, the focus is on productivity and the profitability of existing ranges, with priority given to meeting production rates and maintaining or even lowering prices, rather than to innovation.

Automotive industry

We’re all familiar with the growing presence of electronics on board vehicles, but we’re seeing a clear acceleration in the development of power electronics as well as safety, control and comfort electronics, right up to and including autonomous vehicle electronics. These new applications are generating new needs in terms of sensors, components, connectors, electronic boards, production resources and testing facilities, both for existing players and for new entrants bringing their expertise to the table. It’s also worth noting that France and Europe have maintained a presence across the entire value chain, from component to vehicle, from development to production, in this globalized industry.

Telecommunications market

France’s “industrial” role in this field is now limited, so our colleagues in the components, connectors & printed circuits sector see it as a sluggish market. However, the acceleration of the fiber optic deployment program on the one hand, and developments in 5th generation telephony on the other, are driving investment, particularly in test and measurement resources. We need to wait for the deployment of this “5G” to generate significant new volumes, in connectivity for example.

Internet of Things

It’s a ferment of creativity that we now need to help industrialize, so that French electronics can find its rightful place in terms of materials, components, printed circuits and means of production.

Industrial market (mechatronics/robotics, medical, energy, rail industry)

It’s a traditionally highly fragmented market, often with major export contracts, which our component colleagues see growing steadily, thanks to constant innovation on the part of players and federating programs such as Industrie du futur.

Whatever the Industry, Innovation is clearly the growth factor; in this respect we should mention the importance of the various support programs (French Tech, PIA, Pôles…). For example, our printed circuit board colleagues can attest to the importance of the “Meredit” program for its impact on business and innovation.

In conclusion, French electronics is dynamic and innovative, sometimes even pioneering, because it is at the heart of the major issues of the day (Defense, Autonomous Vehicles, Internet of Things). It’s true that we also benefit from a highly diversified market structure (Aero&Defense, Automotive, Telecom, Industry, Education, Public and Private Research), which opens up a wealth of opportunities, even if sometimes the volume remains limited.

However, we need to remain aware that while French R&D knows how to innovate, it needs major projects to serve; while French creativity is flourishing in the Internet of Things, it is still sometimes difficult to industrialize in France. We therefore need to continue our efforts, not only on the part of all the players in this industry, but also on the part of our public authorities: we need to involve France and Europe in major projects, we need to help and motivate our younger generations to serve Technology with appropriate training, we need to help our champions not only in R&D but also in Industrialization.

Electronics is at the heart of all the societal challenges facing a large country (health, safety, education, communication, transport…), and ACSIEL Alliance Electronique, through regular communication of our vision of the role and place of French electronics, wishes to contribute to this general mobilization.

Next meeting: 2nd quarter 2017