Electronics barometer #ACSIEL – 4th quarter 2022

Paris, February 22, 2023 – The Acsiel electronics barometer has been aggregating quarterly sales in the electronics sector since 2017 in France.

Two indices make up this barometer:

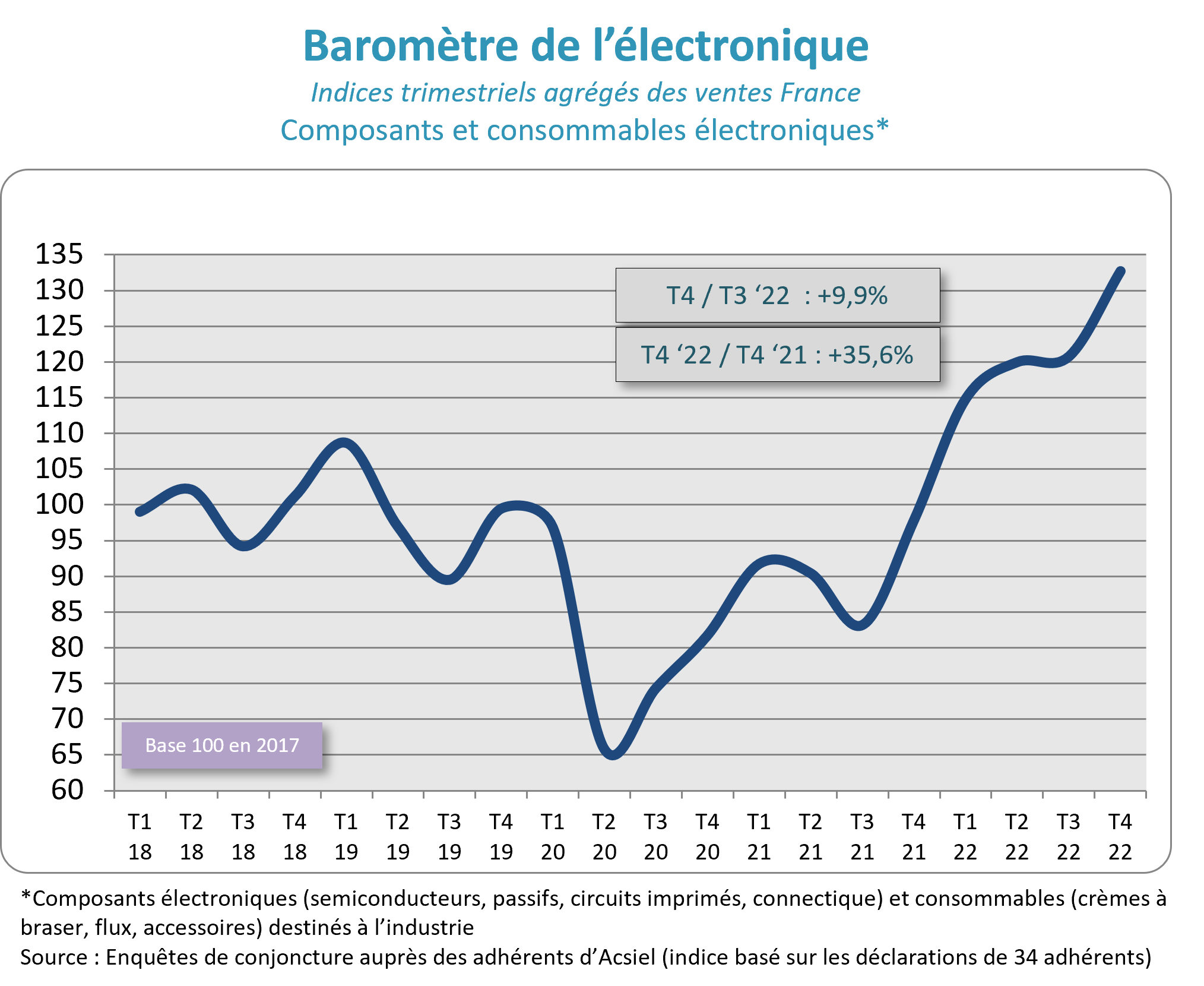

- one indicates sales linked to electronic components (semiconductors, passives, printed circuits, connectors) and consumables (solder pastes, flux, accessories) intended for industry

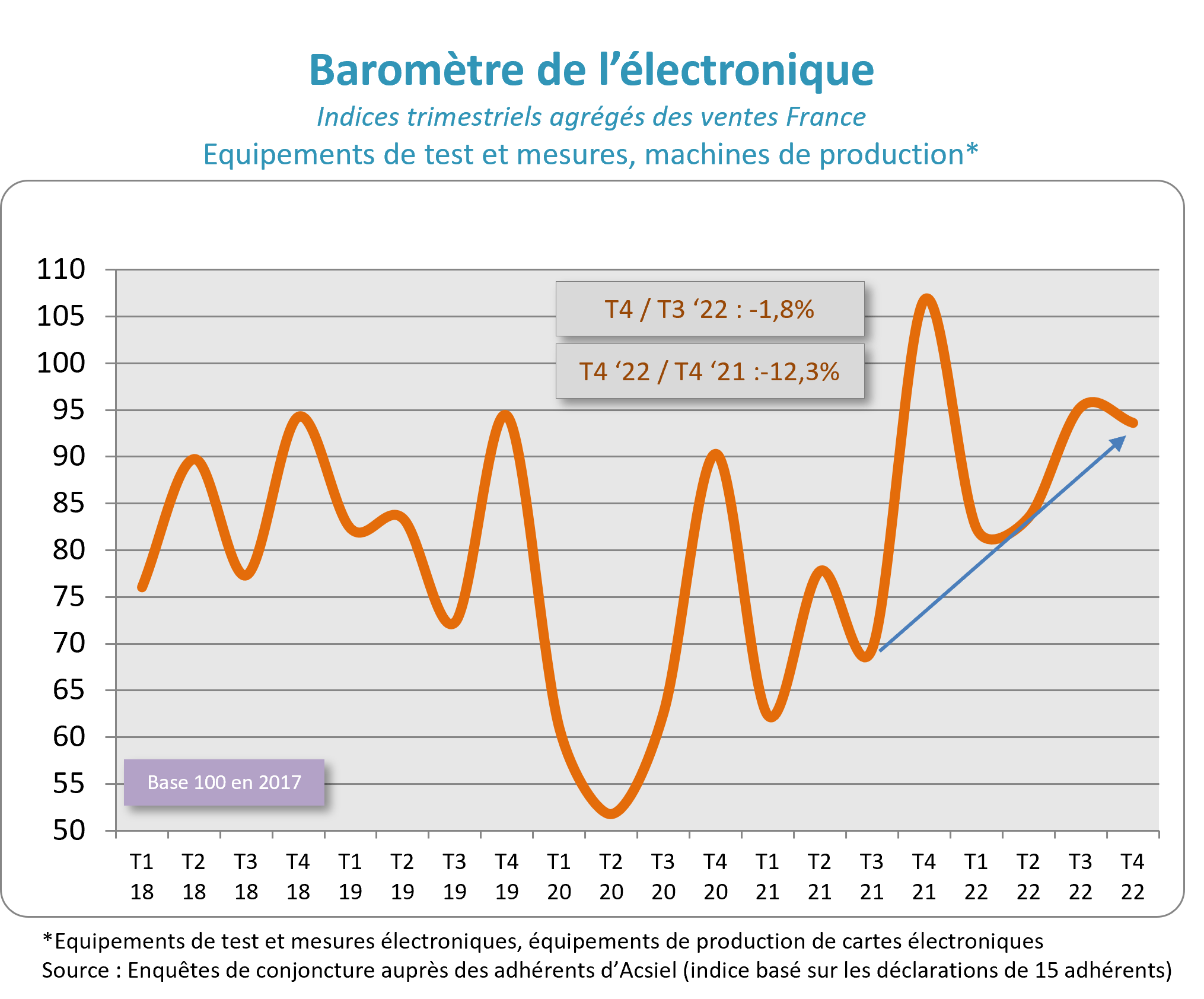

- the other refers to sales related to electronic test and measurement equipment, electronic card production equipment.

The College Equipment & Services and Test & #Acsiel Measurements has just finalized the barometer for the 4th quarter of 2022.

> Electronic components and consumables

Analysis

- Sales of electronic components (semiconductors, passives, printed circuits and connectors) and consumables in France in the fourth quarter of 2022 continued to show strong dynamics which will also have characterized the whole year.

- The electronics sectors where production is currently declining (IT, smartphones, general public, home automation) ultimately have little impact on French demand as a whole. On the other hand, we are witnessing a “favorable alignment of the planets” in the sectors that bring electronics to the domestic market (mainly automobile, industrial, aeronautics/space/defense).

- These good results also illustrate the relevance of the massive investments undertaken by component manufacturers, making it possible to increase volumes to meet demand while being well placed in growing markets .

- Some delays remain very long but we can see the beginning of relaxation. However, there remains strong pressure on the prices of raw materials in 2023, while the increases were essentially recorded in 2022 without really being passed on by manufacturers.

- Industrial relocation efforts are also bearing fruit. Component manufacturers note with satisfaction that equipment manufacturers who had played the offshoring card are once again increasing their orders in France.

> Test and measurement equipment, production machines

Analysis

- In the fourth quarter, growth was strong for production machines. On the other hand, after an exceptional third quarter (unlike seasonality) for test and measurement equipment, we witnessed a slight correction in the fourth quarter. This explains the decline in the quarterly index without erasing the upward trend visible for a year.

- The supporting sectors are the same as for the components. We note that the telecommunications sector is attracting attention in particular with the deployment of 5G but without yet representing large volumes.

- European equipment production is currently suffering from a loss of competitiveness vis-à-vis products manufactured in regions insensitive to rising energy costs (the China in particular). Energy costs and general inflation risk weighing on equipment purchases in certain sectors but the needs are strong.

- On the demand side, investments in measurement means in France are promising and expected to grow even further with projects to build electric car and battery factories .

- On the supply side, with changing customer sectors, electronic equipment manufacturers in France are going through a period of historic transition in which they are adapting through sustained investments. The sums involved are considerable, so support from public authorities remains a key factor in transforming the trial. France must remain at the forefront of innovation and production in electronics, which is the cornerstone of societal developments and a powerful lever of sovereignty.