Situation of the French Semiconductor Market in 4ᵗʰ quarter 2017

Paris, February 26, 2018 – 2017 ended with a third consecutive quarter of growth for the French semiconductor market, according to data compiled by ACSIEL. In the fourth quarter, the total market including semiconductor manufacturers’ sales to OEMs and distributors grew by 2.0% quarter-on-quarter to €518.6m, 3.4% higher than in the fourth quarter of 2016. Sequential growth in the second and third quarters was +6.3% and +2.1% respectively.

In direct sales to OEMs, this quarterly growth in Q4 was driven by the Consumer/Computer and Mil-Aero segments. The Mil-Aero segment overtook the Smart Card segment for the first time, where sales stagnated in Q4. Sales in the Industrial segment dipped noticeably, after a very good third quarter. In terms of products, again in direct sales, growth was driven by the MOS-Micros and Optoelectronics families. Invoiced sales to the retail sector rose by a modest 0.8%.

Fourth-quarter 2017 sales were on a par with the fourth quarter of 2015, and only 1.8% below the all-time record set in the first quarter of 2016.

Sluggish growth but solid foundations in 2017

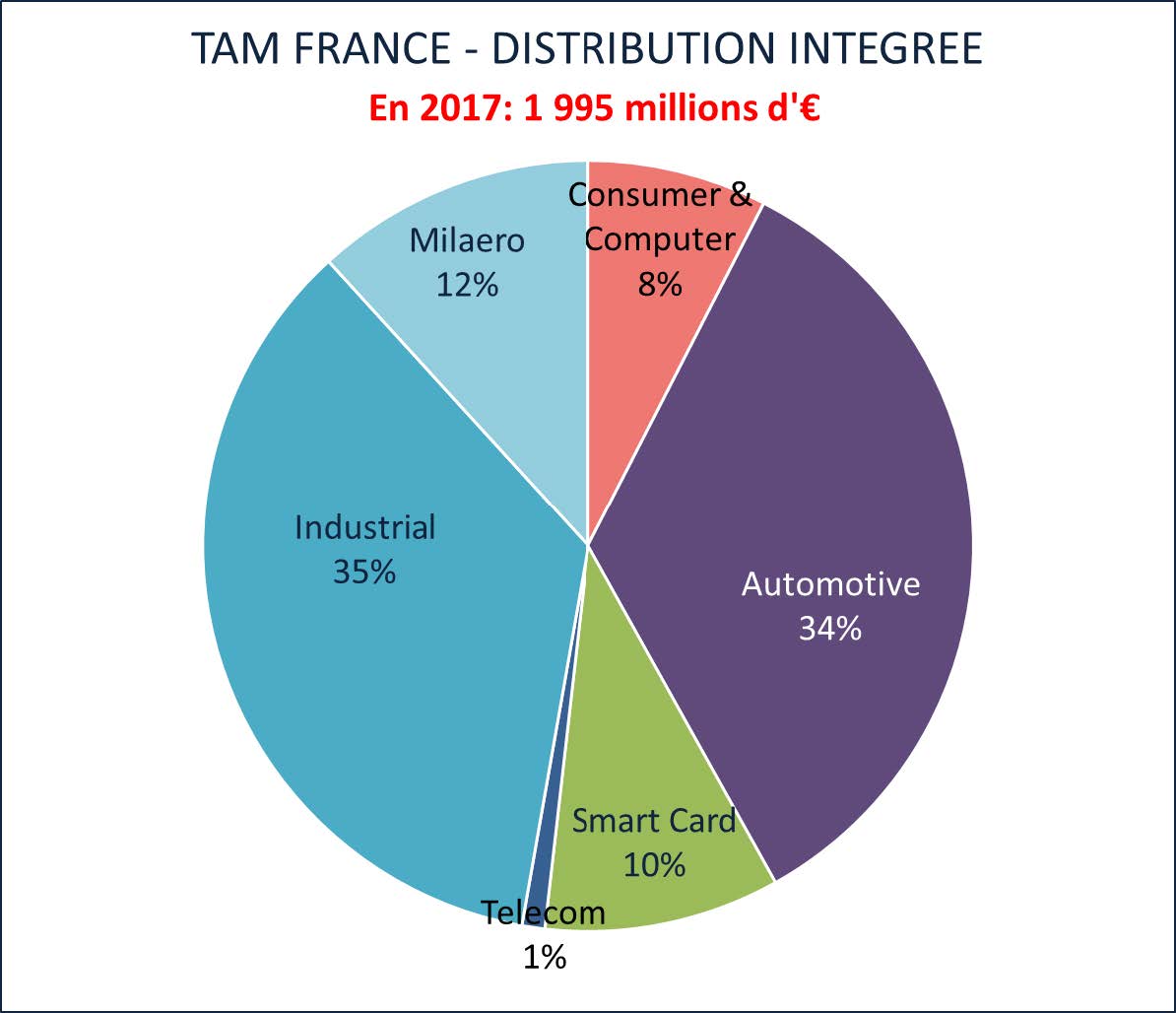

Since 2015, the French market has returned to its 2007 level of around 2 billion euros, recording 1.0% growth in 2017. Sales to distributors, up 10.6% on 2016, were the strongest contributor to annual growth. In 2017, the Distribution channel accounted for 32% of semiconductor sales in France for the first time, representing a 10-point increase in market share in 10 years (it was 22% in 2007).

Including resales by distributors to end customers, the industrial segment was the main contributor to growth in the French semiconductor market in absolute terms, with a 9.8% increase, representing 35% of the market. The Industrial segment was driven in particular by the development of the IoT, reflected in the remarkable growth of Sensors & Actuators products (+33.5%).

Although the automotive segment grew by just 0.9% in 2017, it is one of the traditional bases of the French market, accounting for 34%. The outlook is more favorable than ever, with the multiplication of electronic modules linked to high-growth applications such as driver assistance functions, infotainment, connected vehicles and electric cars.

The Mil-Aero segment posted the strongest growth in 2017 with +26.2%, reflecting in particular the success of the European aerospace sector and the strong growth of on-board electronics in new-generation civil aircraft, as well as the strength of the defense market. With an increase in market share from 9% to 12% between 2016 and 2017, the Mil-Aero segment supplanted the Smart card in third place. The Smart card segment seems to have entered a phase of structural decline in France. It is down -34.5% and sees its share of the French semiconductor market fall from 15% in 2016 to 10% in 2017.

The French semiconductor market is now structured around three key sectors for national electronics production: Industrial, Automotive and Military-Aerospace.

French semiconductor market in 2017, breakdown by major application segments – Source #ACSIEL