Situation of the French semiconductor market in the 2nd quarter of 2020

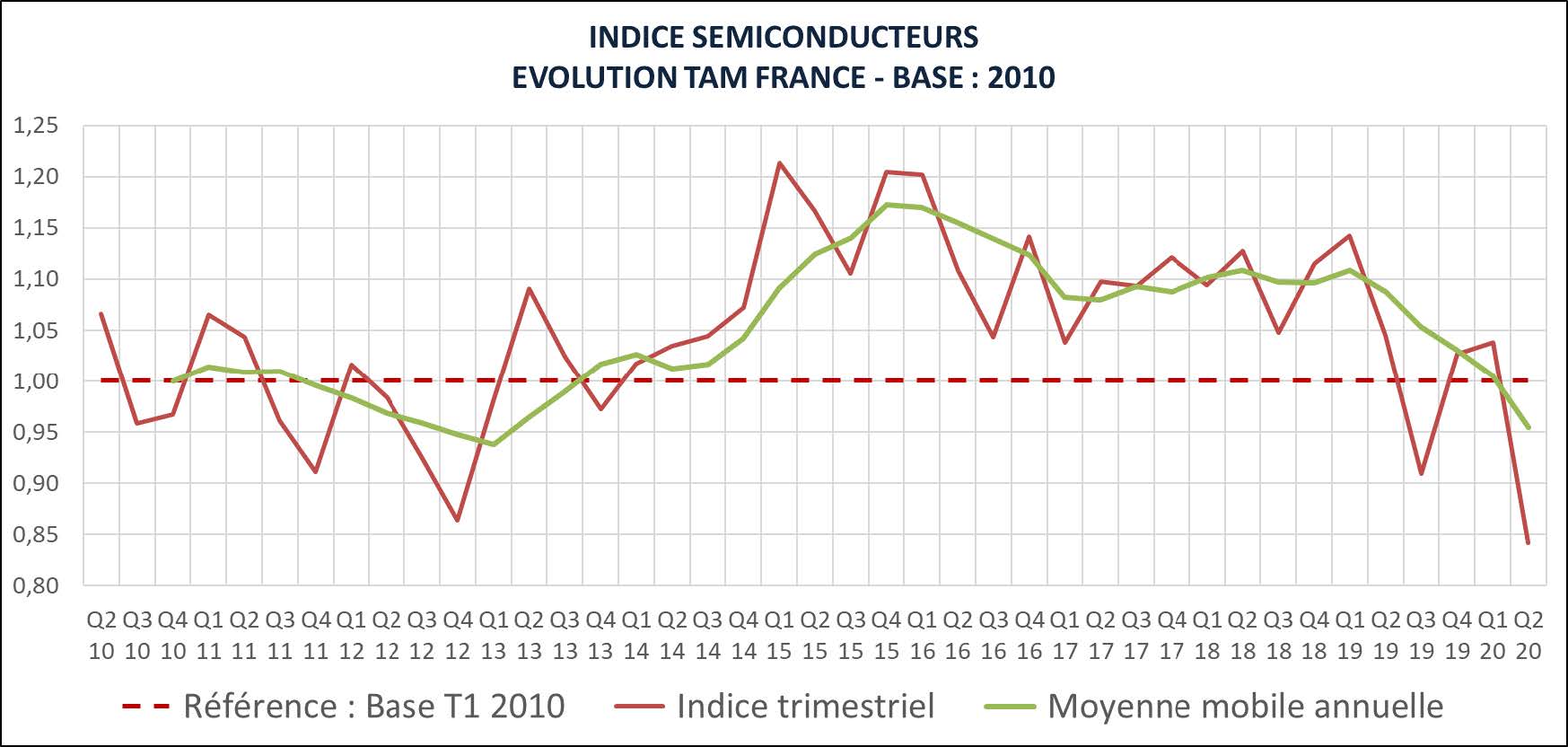

Paris, September 18, 2020 – Going unnoticed in the statistics from the first quarter, the “Covid effect” is obvious in the second (see attached graph). The sharp decline in economic activity has had a significant impact on the semiconductor market in France and throughout Europe. While the WSTS announced a 20% drop in billings in Europe in the second quarter compared to the first, the French market fell by 19% during the same period, according to Acsiel, for an amount of 362 million euros. . The French market is also 19% below its value in the second quarter of 2019. The decline is 14% over the first 6 months of the year and 12% over a rolling 12-month period.

The decline in the second quarter was, however, less significant for sales to distributors (-14%) than for direct sales to equipment manufacturers and integrators (-21%).

The aeronautics, space and defense segment is the only one to have recorded growth in the second quarter compared to the first, due exclusively to the defense and space markets because the demand for civil avionics is very low. All other sectors suffered a more or less spectacular drop in sales. The most affected segment was, as might be expected, automobiles due to the sudden cessation of French vehicle production during confinement. Sequentially, direct sales of semiconductors intended for automotive applications fell 38%, after two quarters of growth in a row. All segments corresponding to IT, consumer, telecom and smart-card applications suffered an overall decline of 14%. In this exceptionally depressed context, the industrial segment showed relative resilience with a drop of 11% after also benefiting from two consecutive quarters of growth.

Regarding products sold directly to equipment manufacturer and integrator customers (OEM and EMS), it is MOS logic integrated circuits which suffered the greatest impact with a decline of 54% compared to the first quarter. Sales of discrete components, sensors and actuators (-37%) as well as those of analog integrated circuits (-32%) were severely affected. This poor performance is largely linked to the downturn in the automotive sector, as well as the -17% drop for “MOS Micros” mainly due to microcontrollers (MCU), many of which are integrated into on-board electronics.

We can discern positive signs for the French semiconductor market. The rebound in automobile sales and production suggests a rapid recovery of this sector, even if uncertainties remain regarding household consumption in the short to medium term. The French market should also continue to benefit structurally from the positive impact of applications linked to the increasing digitalization of society, such as the cloud, 5G, telemedicine, home automation, connected objects, etc.

Evolution by quarter of the French market since 2010, in index, in annual moving average – Source #ACSIEL