Situation of the French Semiconductor Market in the 3ʳᵈ quarter 2019

Paris, November 28, 2019 – The global semiconductor market has suffered a significant slowdown since the fourth quarter of 2018, affecting all product families and regions. Like the European market, the French market has also been affected by this correction, but less strongly and with a time lag, as the cumulative results for the first three quarters of 2019 show.

During this period, the global market saw its level fall by 14.4% in dollar terms compared with the first nine months of 2018, according to WSTS figures. In comparison, according to Acsiel Alliance Electronique, the decline in the French market over the first nine months of the year was 7.2% in euro terms. Direct sales fell by 9.3%, while sales to distributors were down by only 3.0%. As a result, the latter continue to see their market share increase, representing 35.3% of the French market over nine months in 2019 versus 33.8% over the same period in 2018.

In direct sales, it should be noted that the two main segments of the French market, automotive and industrial, were rather less affected than the market as a whole. Over the first three quarters of 2019, the automotive semiconductor market fell by 4.0%, and the market for various industrial applications by 6.4%.

The global semiconductor market saw some of the steepest declines in its history in the fourth quarter of 2018 and the first quarter of 2019. During this period, it was noticeable that the French market was spared from this sharp downturn, notably due to its lower exposure to fluctuations in the memory market (which entered recession as early as the fourth quarter of 2018). As a result, the relative sensitivity of the French market to the state of component inventories in the value chain is all the greater. This goes a long way to explaining why the downturn in the French market lagged the rest of the world by around six months. With the global market showing positive signals as early as September 2019, the outlook for the French market looks much more favorable for 2020.

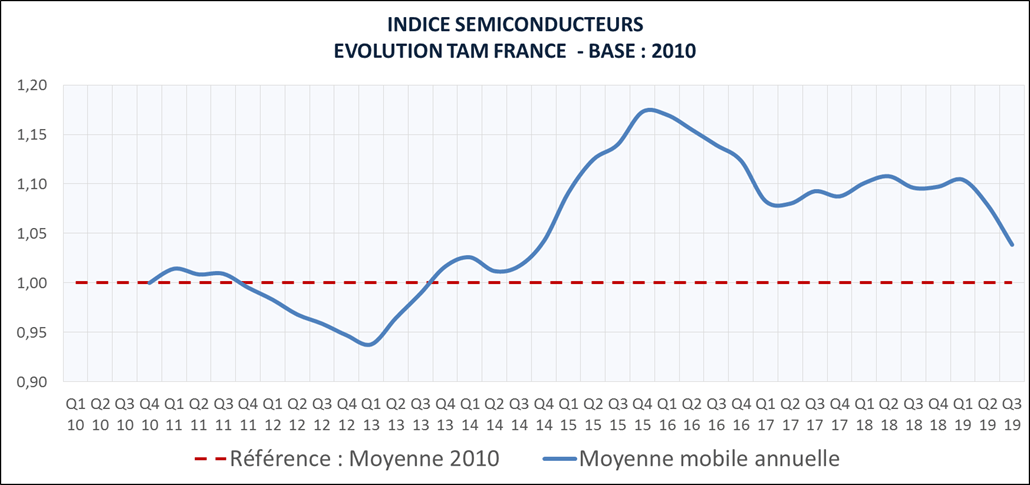

Quarterly trends in the French market since 2010, in indexes, annual moving average – Source #ACSIEL