Situation of the French Semiconductor Market in au 4ᵗʰ quarter 2019

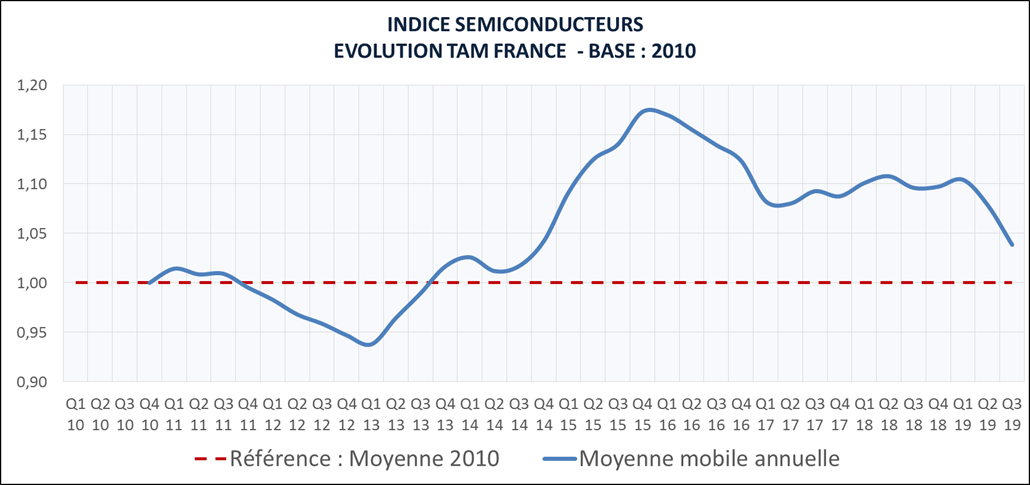

Paris, March 10, 2020 – According to Acsiel Alliance Electronique, the French semiconductor market rebounded strongly at the end of 2019 after two quarters of decline, with growth of 13% in the fourth quarter compared with the third, to 442 million euros. On an annualized basis, this represents an 8% contraction compared with the fourth quarter of 2018. It is, however, an improvement on the cycle low reached in the third quarter at -13% year-on-year.

While distribution sales stagnated in the fourth quarter, it was sales to direct customers that kept the market buoyant, with 20% growth across all sectors. The main contributor to this growth was the military and space segment, where sales almost doubled compared with the very weak third quarter. The automotive segment, which is the largest in terms of direct sales in France, enjoyed growth of 7%. It thus returned to its second-quarter level after having been on a downward trend since the start of 2019. The industrial segment, which had fallen sharply in the second and third quarters, regained 11% in the fourth. Sales for consumer and IT applications, aggregated in Acsiel’s statistics, rose by 47%, following a well-established seasonal pattern.

Among the major product families, it was MOS Micros (MCUs and MPUs) which, by virtue of their size, made the biggest contribution to driving the market upwards, with growth of 25%. For their part, sales of Analog circuits saw the strongest growth in the fourth quarter, with +29%. The Sensors & Actuators category, after three quarters at a constant level, returned to growth with +11%, while sales of Discrete circuits rose by just 4% and MOS Logic by 5%.

In 2019, the French semiconductor market, like the global market as a whole, was affected by the economic downturn. According to Acsiel Alliance Electronique, the French market shrank by 6% to 1.77 billion euros. Direct sales to end-customers fell by 5%, and distribution sales by 7%.

Quarterly trends in the French market since 2010, in indexes, annual moving average – Source #ACSIEL

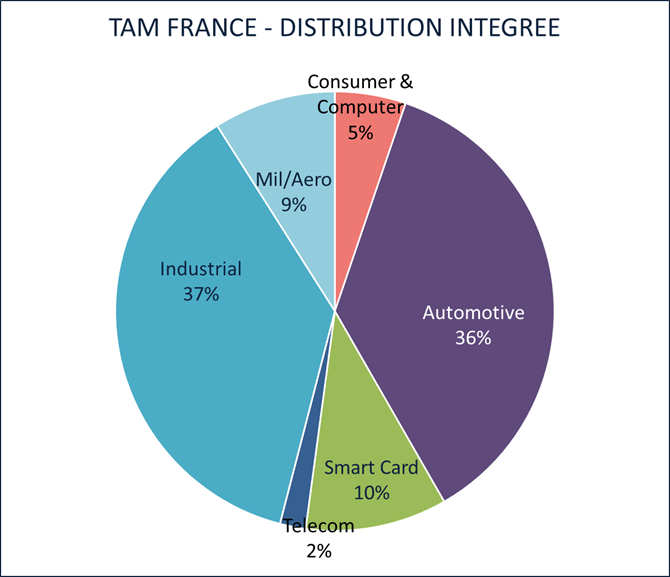

Over the year as a whole, only two application segments enjoyed growth in sales to end customers: consumer and IT (+3%) and military and space (+1%). Sales to other segments fell, led by the Smart Card segment with a decline of 20%, illustrating the structural changes taking place in this industry. Semiconductor sales to industrial applications (-5%) were penalized by inventory corrections, while the automotive segment (-3%) suffered from unfavorable conditions on the global market as a whole.

None of the major product families on the French market was spared from the downturn in 2019, the hardest hit being MOS Logic (-15%), Sensors & Actuators (-13%) and Discretes (-10%). MOS Micros and Optoelectronics were down 7%. Sales of Analog circuits were less penalized, with a decline limited to 3%, in line with the automotive segment, which represents a significant share of their outlets.

Each year, Acsiel Alliance Electronique reallocates distribution sales, representing one third of the market, to each major application segment. The French market is largely dominated by the industrial and automotive sectors, and the respective weight of each segment has remained more or less stable over the past three years (see graph below).

French semiconductor market in 2019, breakdown by major application segments – Source #ACSIEL